Gift Aid Claims - Finance

Link your HMRC Account

You can add your HMRC account details in In Site Settings > Finance > HMRC Submission. |

On the Gift Aid Claims page there are 2 tasks:

-

Create a new claim: This is used to create a new Gift Aid claim to send to HMRC.

-

Manage payments with missing information: This shows you the payments you could claim Gift Aid for, but there is information missing. This tool helps you to see and fix those.

Making a Gift Aid claim

You can only make a claim if there are no existing claims in editing status

Click on Tasks > Make a new claim.

Claim Details

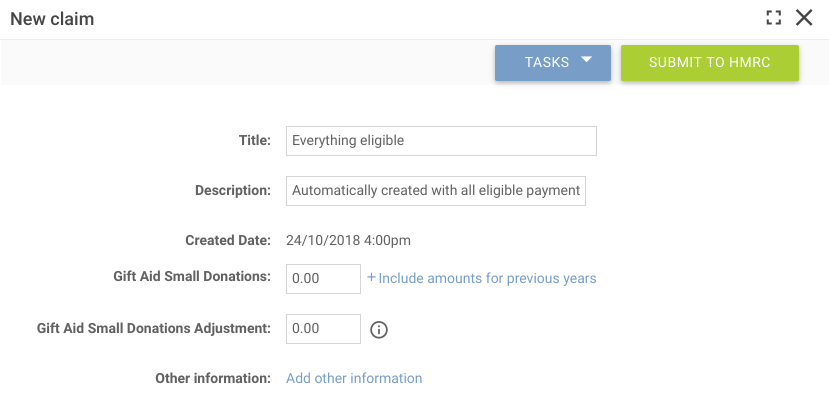

Give the claim a title and description.

You can add an amount for the Gift Aid Small Donations Scheme (GASDS). If required, you can enter amounts for past years, or add an adjustment if you have over claimed previously.

Lastly, you can enter any other information you need to help you keep your records accurate.

Items to Claim

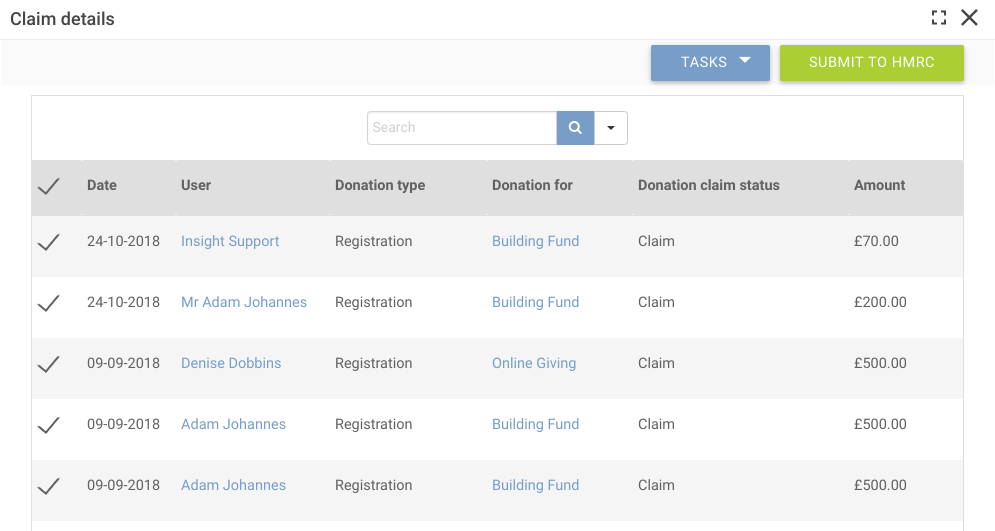

In the table below the Claim Details are the donations eligible for claiming Gift Aid back from HMRC.

You can review these and make sure the left-hand column checkbox is ticked if you want to add the line to the claim. By default, everything is ticked to be included.

When you are ready click on the green ‘Submit to HMRC’ button at the top of the page.

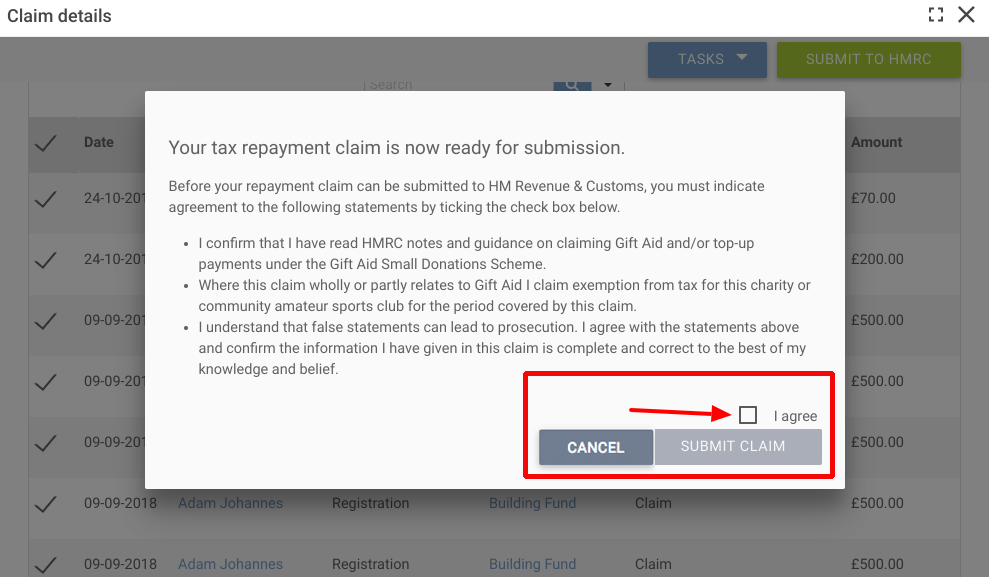

You will be presented with a dialogue that prompts you to agree to the statements before clicking on ‘I agree’, then the green button to ‘Submit Claim’.

You will then be taken back to the list of claims with the claim you have just submitted showing with a status of ‘Pending Submission’.

After a couple of minutes, the status will show as ‘Awaiting HMRC response’.

Once HMRC has processed the claim you will see the status ‘Submitted successfully’

Troubleshooting a claim

If you have an issue with the claim, you can click on the blue pencil icon to open the Claim and use the Task to ‘View HMRC Transmissions’. This includes the information that HMRC will need when you contact them about the claim.

Manage payments with missing information

Click on Tasks > Manage payments with missing information

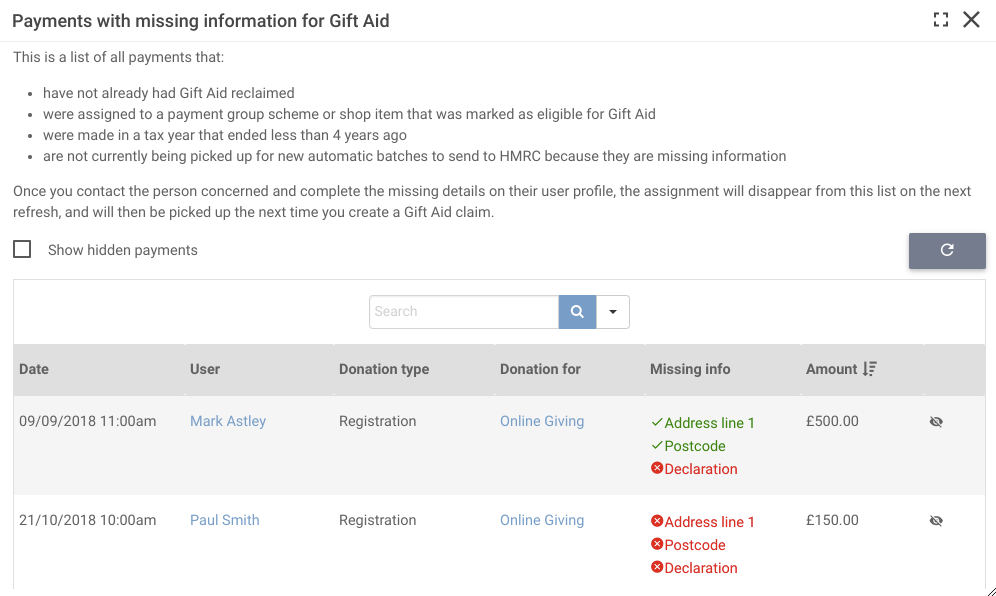

A dialogue will appear with a list of payments that are potentially eligible for Gift Aid.

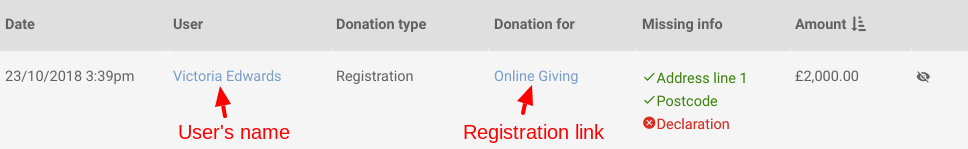

The table shows you the information you need to identify the payment and shows you the missing information that you need to get before you can claim Gift Aid.

Update the list

To update the list at any point, just click on the refresh icon.  |

Depending on the information you need to add, you can click on the user’s name which will bring up their user record, or the link for the donation that will open the edit registration dialogue.

Fix missing information

Address Line 1 & Postcode

Address Line 1 & Postcode:

-

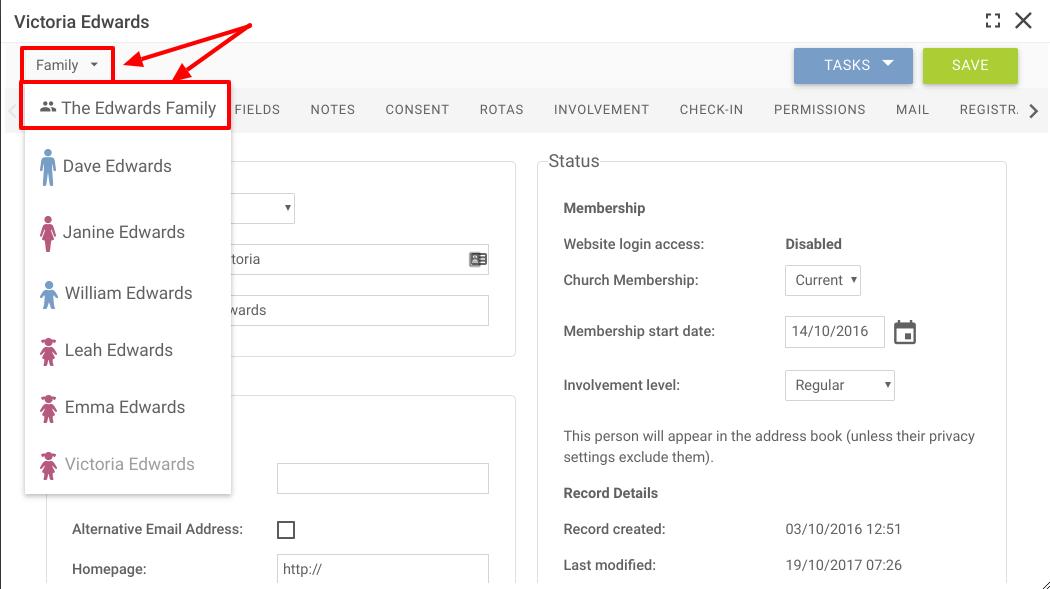

Click on the user’s name to bring up their record and click on their Family box. If there is more than 1 person in the family, click on the family link in the drop-down.

Gift Aid Declaration

Gift Aid Declaration:

-

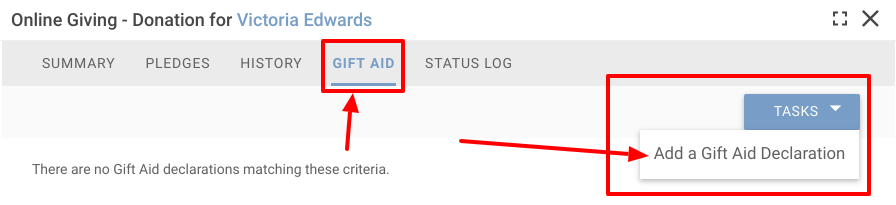

Click on the registration link to bring up the Edit Registration dialogue. Go to the Gift Aid tab and add a declaration.

When the lines are fixed they will be available in the next Gift Aid claim you make. If you are already editing a claim, they will appear in the list of available payments when you open up that claim to continue editing.

More Finance Topics